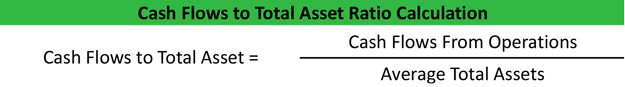

cash flow on total assets formula

It is unreasonable to issue a check for such small expenses and for managing the same custodians are appointed by the company. Net profit Non-cash expenses Total net sales.

Total Assets Formula How To Calculate Total Assets With Examples

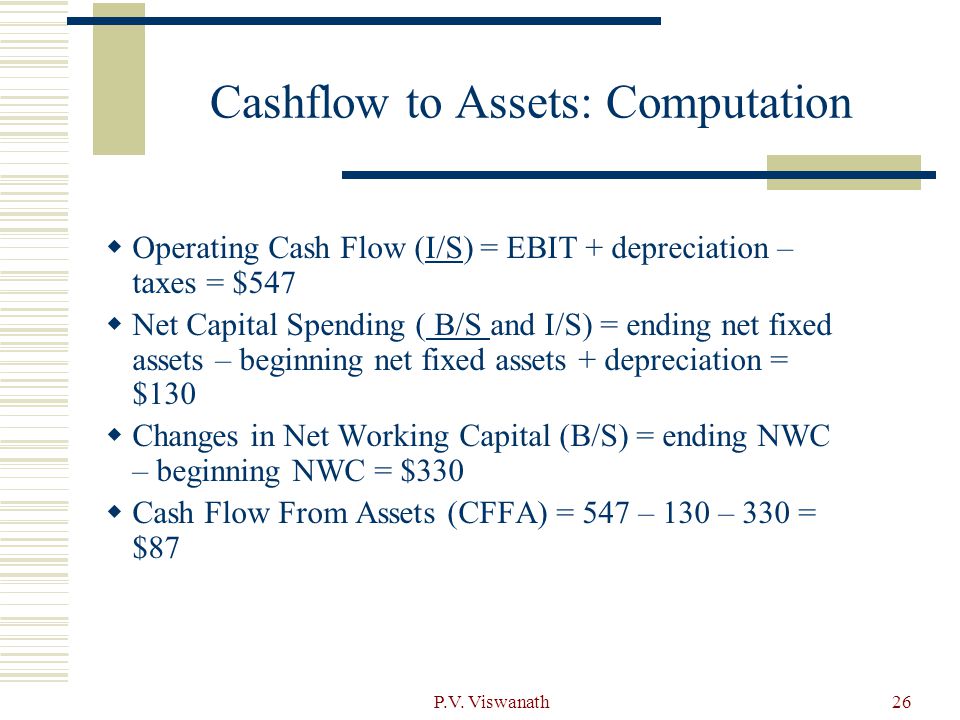

How Cash Flow is Calculated.

. Similarly buying assets will lead to a cash outflow. Cash flow is calculated by changing a few things in the net income of a company. The first step in calculating the cash flow from assets would be a separation of assets into two types.

Not at all. The Operating Cash Flow Formula is used to calculate how much cash a company generated. Cash flows are often transformed into measures that give information eg.

Except for cash less all current liabilities. On a companys value and situation. A cash flow direct method formula is used to calculate cash inflows and cash outflows when preparing a cash flow statement using the direct method.

Generally considered a quick napkin test to determine if the asset qualifies for further review and analysis. Such as by adding or deducting differences in expenses revenue credit transactions and expenses from one period to the nextIt is essential to make adjustments because non-cash things are evaluated with net income income statement and total assets. Free Cash Flow Formula.

The listing shown below. Using the direct method the cash flow from operating activities is calculated using cash receipts from sales interest and dividends and cash payments for expenses interest and income tax. Followed by additions to or subtractions from that amount to adjust the net income to a total cash flow figure.

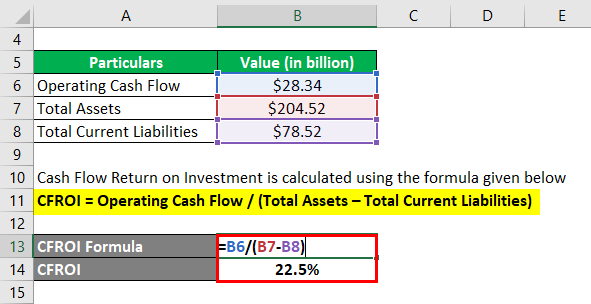

As you can see below investing activities include five. Cash Flow Return on Assets. Cash Flow Statement Guide CFS Cash Flow Statement Guide CFS Cash Flow Statement Core Concepts.

Lets look at an example using Amazons 2017 financial statements. Then your numbers will be overstated. Cash Flow from Investing Activities Example.

Adding Parts 1 2 and 3 together we get the. Just like the cash flow from assets that was generating via operating activities we can use a formula to calculate all the cash flows from assets. The appropriate formulas can be copied from one of the existing items and the sheet reference in the copied formula can then just be replaced by the sheet name of the new amortization table that youve added.

To determine problems with a businesss liquidity. It is often used to evaluate the cash flow from income-producing assets. A cash flow statement is one of the quarterly financial reports publicly traded companies are required to disclose to the US.

Simply put you calculate OCF using the following formula. With the total amortization increasing from 10k in Year. Free cash flow helps companies to plan their expenses and prioritize.

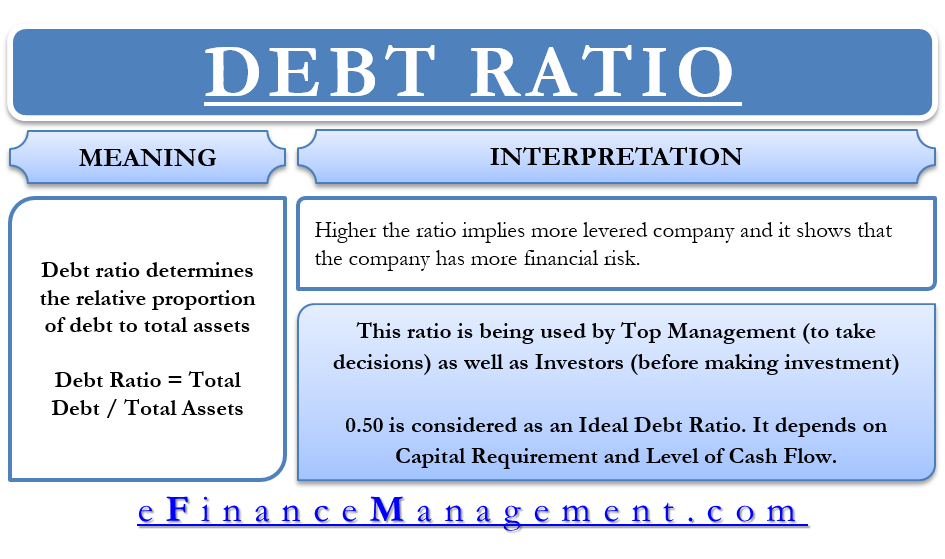

EBITDA stands for earnings before interest taxes depreciation and amortization. Cash Flow Coverage Ratio Operating Cash Flows Total Debt. It is the leftover money after accounting for your capital expenditure and other operating expenses.

Cash flow from Investments formula Cash inflow from Sale of Land Cash outflow from PPE 30000 50000 -20000. In an asset-intensive industry it makes sense to measure the productivity of the large investment in assets by calculating the amount of cash flow generated by those assets. This article on forecasting cash flow is the last part of the four-step financial forecasting model in Excel.

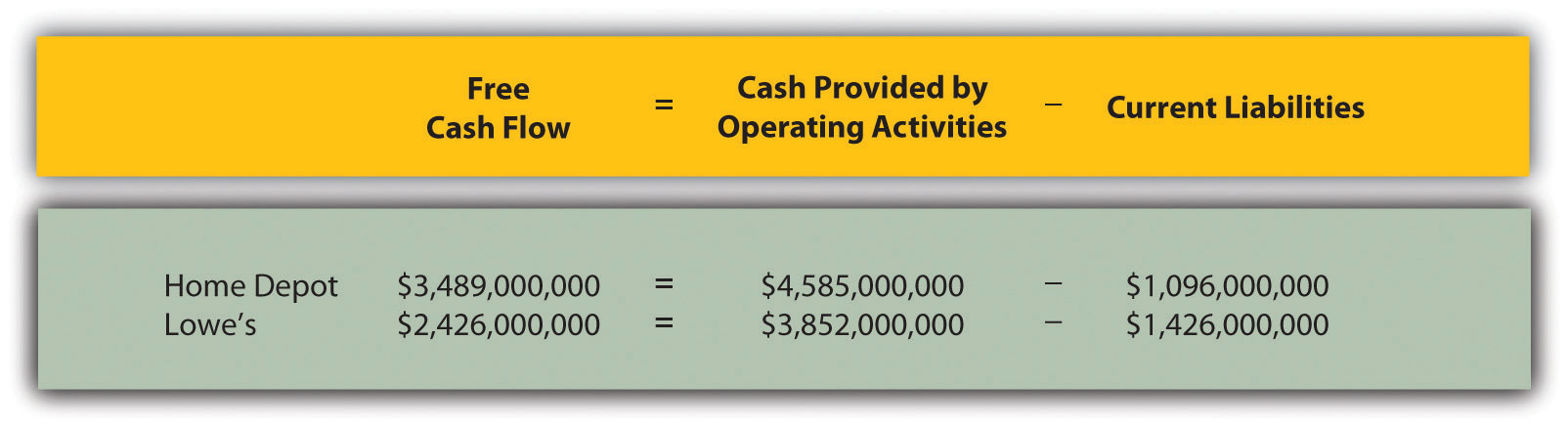

A general measure of the companys ability to pay its debts uses operating cash flows and can be calculated as follows. Any changes in current assets other than cash and current liabilities affect the cash balance in operating activities. The free cash flow FCF formula calculates the amount of cash left after a company pays operating expenses and capital expenditures.

Any changes in the values of these long-term assets other than the impact of depreciation mean there will be investing items to display on the cash flow statement. Under the straight-line method. Amortization of Intangible Assets Formula.

An increase in current assets causes a reduction in cash while an increase in current liabilities causes an increase in cash. EBITDA is one indicator of a companys. You should firstly make up a cash flow statement in the local currency and only then translate it to a presentation currency.

Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. By adding the purchases of intangible assets as per the cash flow statement and deducting the amortization charges which need to be. To determine a projects rate of return or value.

OCF Total Revenue Operating Expenses. However over the. Once you have this cash flow statement in the local currency use the average rate the same as with PL statement.

The bulk of the positive cash flow stems from cash earned from operations which is a good sign for investors. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value. Securities and Exchange Commission SEC and the.

There are a few different ways to calculate the cash flow coverage ratio formula depending on which cash flow amounts are to be included. The price-to-cash-flow ratio is a stock valuation indicator that measures the value of a stocks price to its cash flow per share. From this CFS we can see that the net cash flow for the 2017 fiscal year was 1522000.

Total Operating Cash Flow. Read more checking account Checking Account A checking account is a bank account that allows multiple. Read more for clues about the companys situation.

While investing activities include the sale or purchase of assets and financing activities with the issuance of shares and raising debt. A big chunk of his cash flow7000 out of a total cash flow of 13000came from Increase in Accounts Payable. The ratio takes into consideration a.

What is added or subtracted are changes in the account balances of items found in current assets and current. From forecasting all three activities we will arrive at the forecast net cash movement. In investing the cash-on-cash return is the ratio of annual before-tax cash flow to the total amount of cash invested expressed as a percentage.

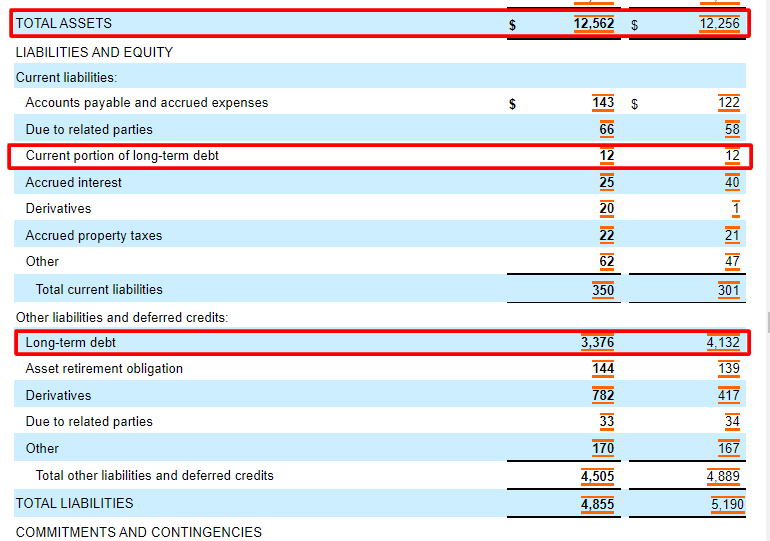

Based on the accounting equation that states that the sum of the total liabilities and the owners capital equals the total assets of the company. Therefore OCF 500. Positive cash flow indicates that a companys liquid assets are increasing enabling it to settle debts.

Cash comprises currency coins petty cash Petty Cash Petty cash means the small amount that is allocated for the purpose of day to day operations. The closer your assets are to being cash the more liquid they are. EBITDA - Earnings Before Interest Taxes Depreciation and Amortization.

Suppose a company has a net income of 756 a non-cash expense of 200 and changes in asset-liability ie inventory is 150 account receivable Account Receivable Accounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. While a cash flow statement shows the cash inflow and outflow of a business free cash flow is a companys disposable income or cash at hand. The formula is.

Cash Flow Statement.

What Is The Debt To Total Assets Ratio Bdc Ca

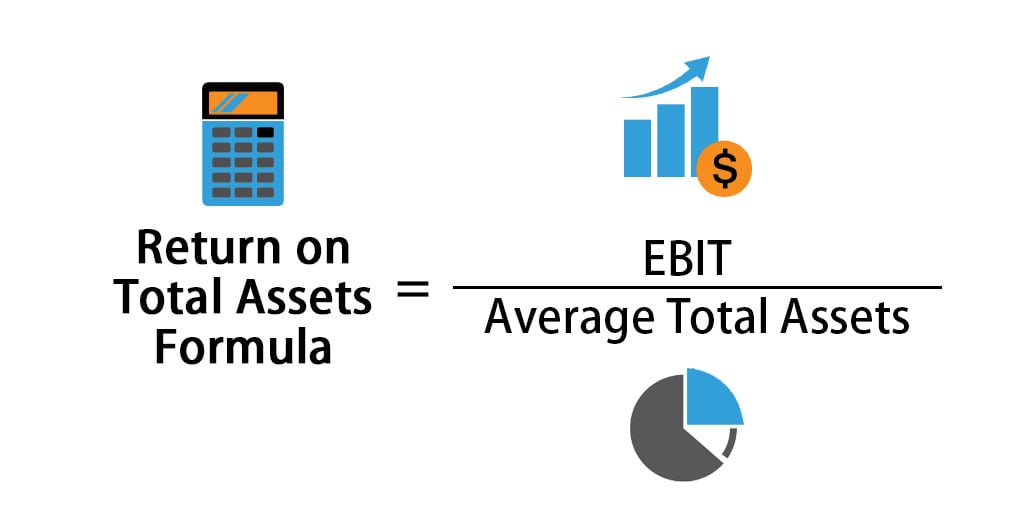

Return On Total Assets Ratios Calculations Arbor Asset Allocation Model Portfolio Aaamp Value Blog

Asset Turnover Formula And Calculator

Analyzing Cash Flow Information

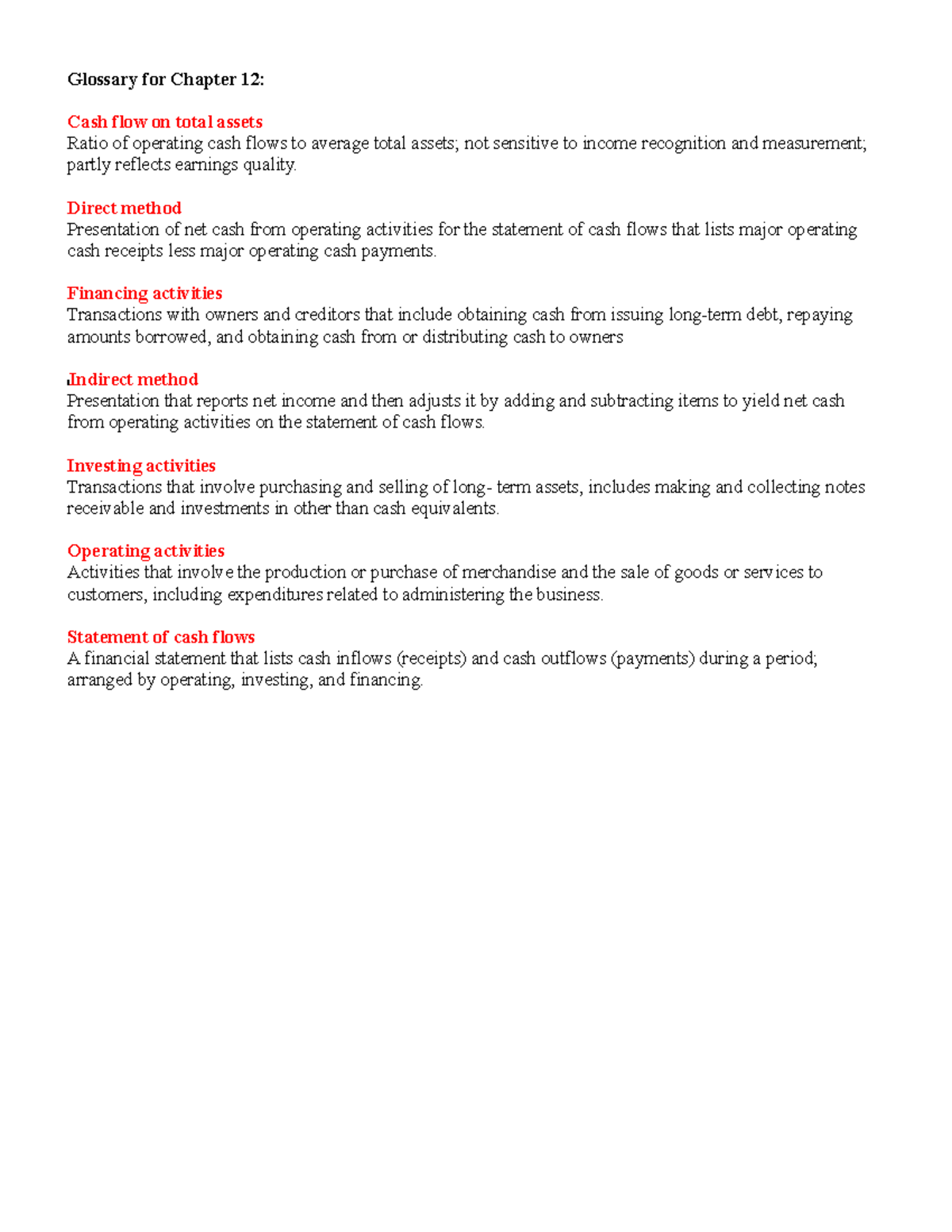

Chapter 12 Glossary Notes Glossary For Chapter 12 Cash Flow On Total Assets Ratio Of Studocu

Return On Total Assets Formula Calculation Examples Excel Template

Cash Flow Ratio Analysis Double Entry Bookkeeping

Solved Key Figures For Apple And Google Follow Millions Chegg Com

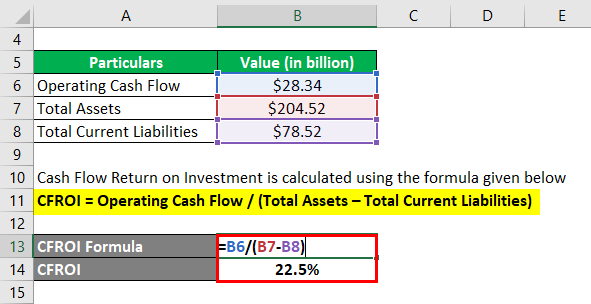

Cash Flow Return On Investment Examples With Excel Template

Cash Return On Assets Ratio Formula Calculator Updated 2022

Accounting And Finance Ppt Video Online Download

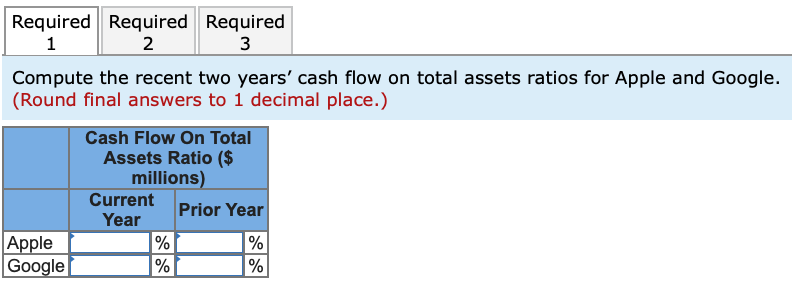

Answered Cash Flow On Total Assets Ratio Is Bartleby

What A Good Debt To Asset Ratio Is And How To Calculate It

Debt Ratio Definition Formula Use Ideal Example Efm

Asset Turnover Formula And Calculator

What Is Cash Flow On Total Assets Ratio Definition Meaning Example

Solved Use The Cash Flow On Total Assets Ratio To Determine Chegg Com